• You can apply for our digital credit card products that we have added to our credit card portfolio and benefit from all the advantages of our digital credit cards with no card fees for life.

• If you are a corporate ING customer, you can secure your loan with the life insurance included in the SME Instant Loan and grow your business with confidence.

• You can easily approve the General Loan Agreement without going to the branch.

• You can apply for our digital credit card products that we have added to our credit card portfolio and benefit from all the advantages of our digital credit cards with no card fees for life.

• If you are a corporate ING customer, you can secure your loan with the life insurance included in the SME Instant Loan and grow your business with confidence.

• You can easily approve the General Loan Agreement without going to the branch.

We continue to improve ING Mobile to provide you with a perfect banking experience.

In this version of ING Mobile:

• In the updated campaigns menu, you can easily find the campaigns you're interested in using filters and view your rewards in the details page.

• From the Update Mobile Phone Number section, you can easily update your mobile number without going to a branch.

Thank you for using ING Mobile.

Don't forget to share your comments and suggestions with us.

We continue to improve ING Mobile to provide you with a perfect banking experience.

In this version of ING Mobile:

You can now track your card and credit limit applications more easily on the Application Tracking screen in the Applications menu.

You can easily update the address where your card will be sent during the application process.

Thank you for using ING Mobile.

Don't forget to share your comments and suggestions with us.

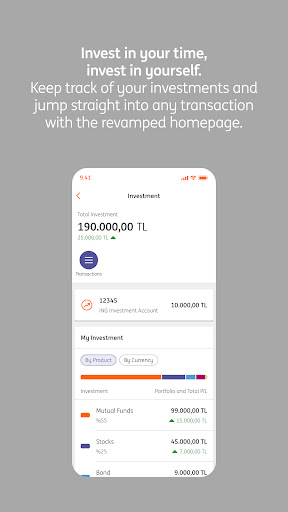

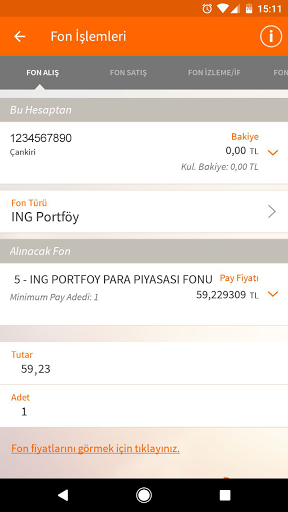

· From the investments screen in the products menu, you can now easily perform Bond, Eurobond, and Treasury Bill buying and selling transactions.

· You will be able to view the fund portfolio view, fund buying/selling and order editing, ING Investment Account opening and risk profile survey screens with the new design.

· From the Address information screen in the profile menu, you can both confirm your address details and update your address information by uploading your residence document.

We continue to improve ING Mobile to offer you a perfect banking experience.

With this update, we’ve made performance and experience improvements in the application.

In this version of ING Mobile, you can view your daily withdrawal limit when withdrawing money with a QR Code from ING ATMs and partner bank ATMs.

Thank you for using ING Mobile!

We hope you enjoy using ING Mobile and would like to hear your feedbacks.

We continue to improve ING Mobile to give you a perfect banking experience.

With this update we’ve made performance and experience improvements in the application.

We hope you enjoy using ING Mobile and would like to hear your feedbacks.

We continue to improve ING Mobile to give you a perfect banking experience.

With this update we’ve made performance and experience improvements in the application.

We hope you enjoy using ING Mobile and would like to hear your feedbacks.

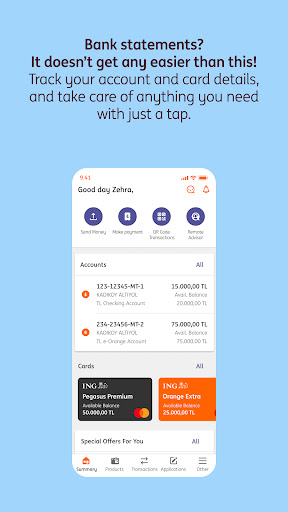

A much easier, faster and reliable banking experience awaits you in ING Mobil, which we have renewed with your comments.

With its new design and features, you can perform your daily banking transactions 24/7 from ING Mobil

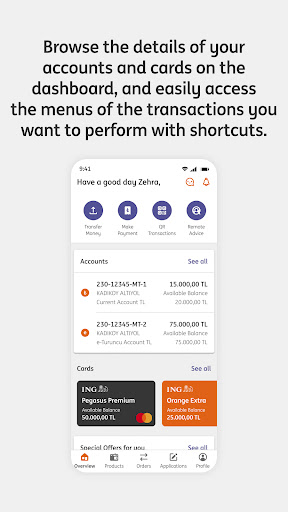

• You can select your most frequently used accounts and cards and view the details on the dashboard and personalize your banking experience by saving your favorite transactions.

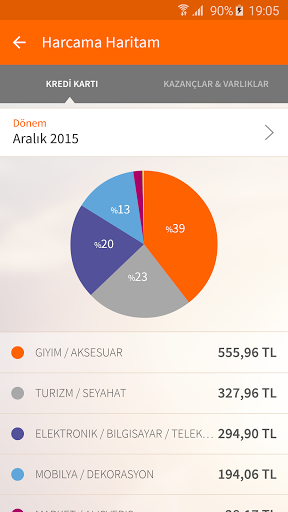

• You can evaluate your financial situtation by viewing your assets and debts graphically

A much easier, faster and reliable banking experience awaits you in ING Mobil, which we have renewed with your comments.

With its new design and features, you can perform your daily banking transactions 24/7 from ING Mobil

• You can select your most frequently used accounts and cards and view the details on the dashboard and personalize your banking experience by saving your favorite transactions.

• You can evaluate your financial situtation by viewing your assets and debts graphically

A much easier, faster and reliable banking experience awaits you in ING Mobil, which we have renewed with your comments.

With its new design and features, you can perform your daily banking transactions 24/7 from ING Mobil

• You can select your most frequently used accounts and cards and view the details on the dashboard and personalize your banking experience by saving your favorite transactions.

• You can evaluate your financial situtation by viewing your assets and debts graphically

A much easier, faster and reliable banking experience awaits you in ING Mobil, which we have renewed with your comments.

With its new design and features, you can perform your daily banking transactions 24/7 from ING Mobil

• You can select your most frequently used accounts and cards and view the details on the dashboard and personalize your banking experience by saving your favorite transactions.

• You can evaluate your financial situtation by viewing your assets and debts graphically

You can have a much more easier retail and corporate mobile banking experience thanks to the developments we made on ING Mobile!

Our new version of ING Mobile;

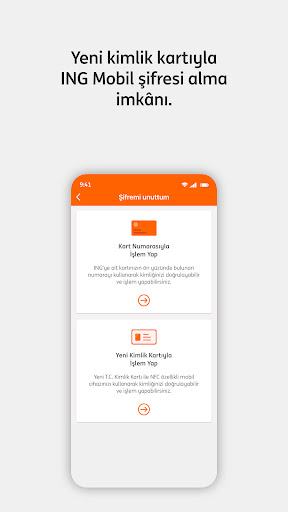

· If our self-employed customers do not know or remember their ING Mobile password anymore, they can easily obtain their password by using their new ID card.

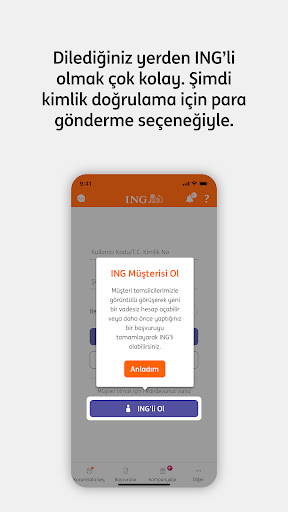

· Self-employed customers can instantly become an ING member by using the money transfer option at the ID verification step.

Thank you for using ING Mobile!

You can have a much more easier retail and corporate mobile banking experience thanks to the developments we made on ING Mobile!

On the new version of ING Mobile;

- We made some performance improvements.

Thank you for using ING Mobile!

You can have a much more easier retail and corporate mobile banking experience thanks to the developments we made on ING Mobile!

On the new version of ING Mobile;

- We made some performance improvements.

Thank you for using ING Mobile!

Our customers are now having a more effortless mobile banking experience thanks to the developments we have made at ING Mobile.

On the new version of ING Mobile for our corporate customers,

· If you have chipped ID cards and NFC supporting devices you can now go through your loan application much faster and disburse your loan digitally.

· Our self-employed customers can apply for loan after logging into ING Mobile Corporate.

Thank you for using ING Mobile! Stay tuned for exciting news!

Our customers are now having a more effortless mobile banking experience thanks to the developments we have made at ING Mobil.

On the new version of ING Mobil;

• We have made performance improvements for you to enjoy ING Mobil even more.

Thank you for using ING Mobil! Stay tuned for exciting news!

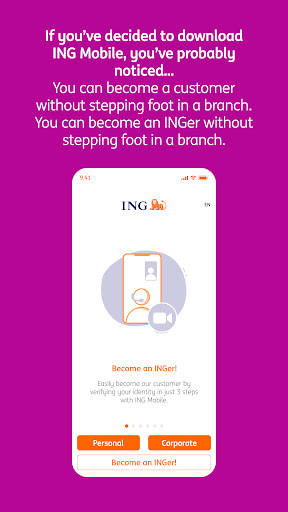

On the new version of ING Mobile;

• Now you can easily load money to your Istanbul Card through ING Mobile, and you can save your card and reload money again.

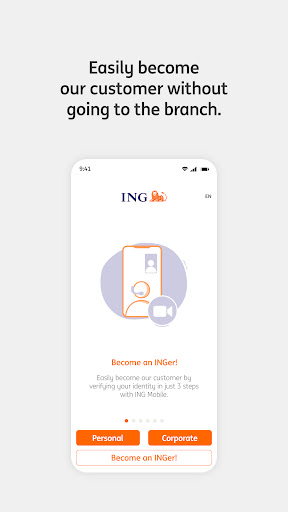

• Sole proprietorships can easily become an ING customer without going to branch.

• Sole proprietorships can easily become an ING customer by being redirected to the Become an ING customer process after applying for a loan through ING Mobile. At the end of the Become an ING Member process, they can resume their loan application.

On the new version of ING Mobile;

• Now you can easily load money to your Istanbul Card through ING Mobile, and you can save your card and reload money again.

• Sole proprietorships can easily become an ING customer without going to branch.

• Sole proprietorships can easily become an ING customer by being redirected to the Become an ING customer process after applying for a loan through ING Mobile. At the end of the Become an ING Member process, they can resume their loan application.

On the new version of ING Mobile;

• Now you can easily load money to your Istanbul Card through ING Mobile, and you can save your card and reload money again.

• Sole proprietorships can easily become an ING customer without going to branch.

• Sole proprietorships can easily become an ING customer by being redirected to the Become an ING customer process after applying for a loan through ING Mobile. At the end of the Become an ING Member process, they can resume their loan application.

Our customers are now having a more effortless mobile banking experience thanks to the developments we have made at ING Mobil.

On the new version of ING Mobil;

• We have made performance improvements for you to enjoy ING Mobil even more.

By updating ING Mobile,

• You can complete your cash management approval process faster by making multiple selections for your bulk payment files.

Thank you for using ING Mobil! Less time for banking, more time for life through ING!

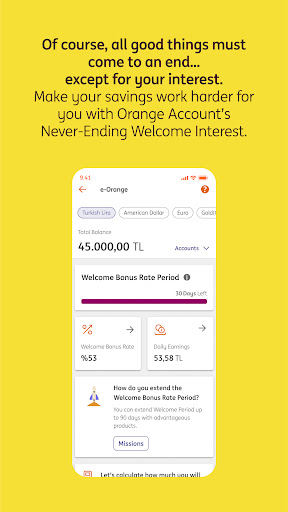

Thanks to the new version,

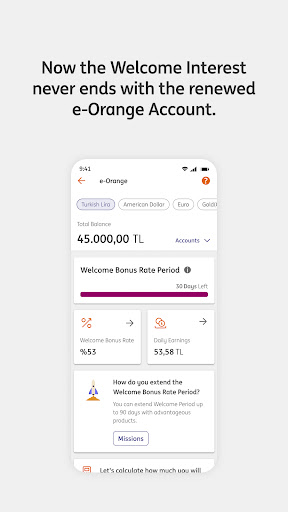

• You can build up savings at the target amount, you have set by means of the Accumulating Account, and you can earn interest yields on each day.

• You can have treatment cost coverage against cancer diseases by purchasing the "In Sickness and Health" insurance policy.

• You can unblock your SIM card by making use of your NFC-featured telephone when you have changed your SIM card.

Less time for banking, more time for life through ING!

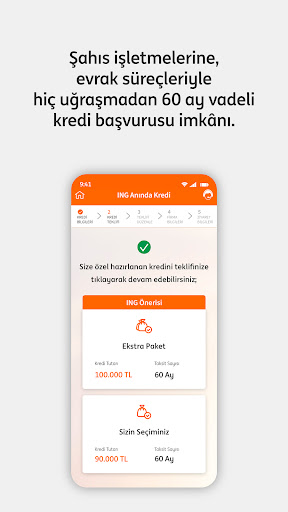

Thanks to the new update of the ING Mobile;

· Our self-employed customers can apply for credits for up to 100.000 TL and up to 60 months maturity and following document approvals transfer amounts to their accounts through ING Corporate Mobile.

· Our corporate customers can use credits or set limits for credit usage for other users without needing full authorization.

Thanks to the new update of the ING Mobile;

• You can obtain your ING Mobile password by using your new ID card.

• You can instantly become an ING member upon the money transfer.

• You can share your account information and transfer money and make your POS payments by using the QR code through the ING Mobile.

• You can purchase the Personal Accident, My Statement Is Safe, Electronic Device and Orange Life Insurance through the ING Mobile.

Thanks to the new update of the ING Mobile;

• You can obtain your ING Mobile password by using your new ID card.

• You can instantly become an ING member upon the money transfer.

• You can share your account information and transfer money and make your POS payments by using the QR code through the ING Mobile.

• You can purchase the Personal Accident, My Statement Is Safe, Electronic Device and Orange Life Insurance through the ING Mobile.

Less time for banking, more time for life through ING Mobile!

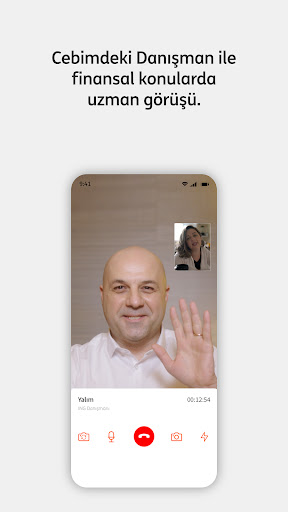

By downloading the new version of ING Mobile;

Our retail customers can;

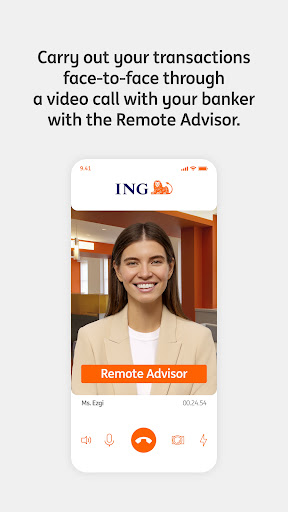

Obtain support from Cebimdeki Danisman about the insurance products in addition to the investment, and

Make savings by means of Koy Kenara that enables them to round up their expenses performed through the Orange Extra Debit Card.

Our corporate customers can;

Utilize and repay loans in capacity of limited liability company and joint stock company.

Yeni ING Mobil ile ING’li olmak isteyen herkes, şubeye gitmeden/kurye beklemeden ING’li olabilir!

Bireysel müşterilerimiz

· FAST ile 1.000 TL’ye kadar 7/24 para gönderebilir

· Tamamlayıcı Sağlık Sigortası’na başvurabilir

· Kapalı kredi kartlarının ekstrelerini görüntüleyebilir

· ATM para çekme limitlerini değiştirebilirler.

Kurumsal müşterilerimiz

· FAST ile 1.000 TL’ye kadar 7/24 para gönderebilir

· QR kod ile para çekebilir

You can have a much more easier retail and corporate mobile banking experience thanks to the developments we made on ING Mobile!

On the new version of ING Mobile;

We made some performance improvements.

By updating ING Mobile;

You can make SWIFT transactions from ING Mobile.

Thank you for using ING Mobile!

You can have a much more easier retail and corporate mobile banking experience thanks to the developments we made on ING Mobile!

On the new version of ING Mobile;

We made some performance improvements.

By updating ING Mobile;

You can identify any information such as Republic of Turkey ID number, mobile phone number, etc. to your accounts as easier address, and you can use it instead of IBAN and account number information.

Thank you for using ING Mobile!

You can have a much more easier retail and corporate mobile banking experience thanks to the developments we made on ING Mobile!

On the new version of ING Mobile;

We made some performance improvements.

By updating ING Mobile;

You can identify any information such as Republic of Turkey ID number, mobile phone number, etc. to your accounts as easier address, and you can use it instead of IBAN and account number information.

Thank you for using ING Mobile!

You can have a much more easier retail and corporate mobile banking experience thanks to the developments we made on ING Mobile!

On the new version of ING Mobile;

We made some performance improvements.

Thank you for using ING Mobile!

You can have a much more easier retail and corporate mobile banking experience thanks to the developments we made on ING Mobile!

On the new version of ING Mobile;

• We made some performance improvements.

You can have a much more easier retail and corporate mobile banking experience thanks to the developments we made on ING Mobile!

On the new version of ING Mobile;

We made some performance improvements.

Thank you for using ING Mobile!

You can have a much more easier retail and corporate mobile banking experience thanks to the developments we made on ING Mobile!

On the new version of ING Mobile;

We made some performance improvements.

We have published the statutory obligations.

Thank you for using ING Mobile!

On the new version of ING Mobile;

•You can list the devices you have activated in "My Page" menu and view their locations,

•With the Applications menu, you can access all the information you need about the products,

•You can increase your Company Credit Card, Support Account or Installment Commercial Credit Limits (for ING SME Digital customers),

•If you are a limited or joint stock company, you can open an e-Orange Account,

•If you have ING POS, you can use the new merchant management panel.

For self-employed individuals, ING POS in Pocket added to SME Instant POS.

We have introduced a few arrangements to offer you an easier mobile banking experience!

We have improved the performance of ING Mobil.

Accordingly;

· You'll be able to look into the details of your Individual Pension Agreement.

· You'll be able to access your documents on "My Page".

Thanks for using ING Mobil!

We have introduced a few arrangements to offer you an easier mobile banking experience!

We have improved the performance of ING Mobil.

Accordingly;

· You can now view your investment statements, set or change your preferred delivery type, and grant annual agreement using ING Mobil.

Thanks for using ING Mobil!

We have introduced a few arrangements to offer you an easier mobile banking experience!

We have improved the performance of ING Mobil.

Accordingly;

You can now increase your credit card limit easily via ING Mobil.

Thanks for using ING Mobil!

-Performance enhancements have been carried out.

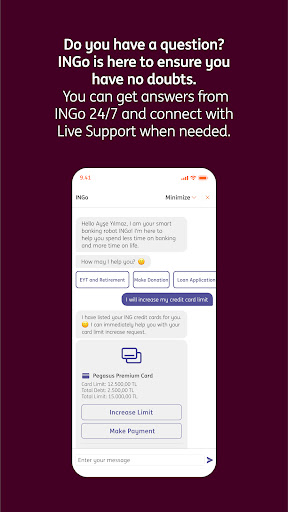

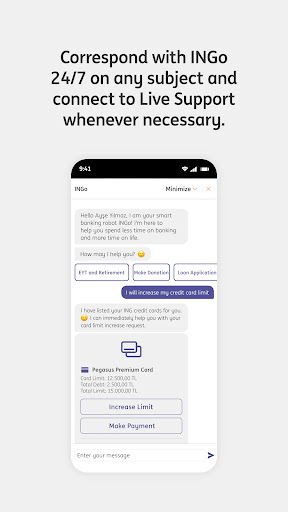

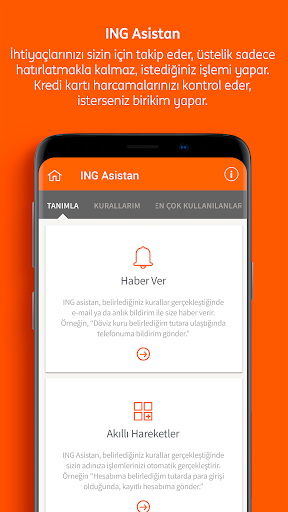

INGo is now available after you logged in!

With this developments, INGo is able to,

-Direct you to the page that you want

-Show your products like accounts and assist you to make your payments

-Help you to change settings, card or digital banking passwords

-Allow you to declare your lost or stolen card

-Give information about 14 different exchange rates and help you to make currency transactions

* View special offers in the Campaigns area Huawei smart phones with installment opportunities are now available in TaksitMaksit.

* Apply for a loan or view your loans details from Loans menu.

* Buy, Sell or Cancel “Special Investment Funds”.

* From Contact Us menu select the appointment time. We will call you.

* Save your regular money transfer before the transaction. Your transaction will happen on the day indicated.

* Performance enhancements have been carried out.

* View special offers in the Campaigns area Huawei smart phones with installment opportunities are now available in TaksitMaksit.

* Apply for a loan or view your loans details from Loans menu.

* Buy, Sell or Cancel “Special Investment Funds”.

* From Contact Us menu select the appointment time. We will call you.

* Save your regular money transfer before the transaction. Your transaction will happen on the day indicated.

* Performance enhancements have been carried out.

View special offers in the Campaigns area

We opened the doors of shopping with TaksitMaksit! Huawei smart phones with installment opportunities are now available

Apply for a loan or view your loans details from Loans menu

Buy, Sell or Cancel “Special Investment Funds”

From Contact Us menu select the appointment time you want to contact us. we will call you.

Save your regular money transfer before making the transaction. Your transaction will happen on the day indicated

+ You can see your current & future credit card spending forecast.

+ You can turn your cards on and off to all transactions and abroad.

+ You can add installment to the appropriate transactions with split transaction feature.

+ You can reach the expense objection form on the Cards menu.

+ Self-employeds can apply SME Quick e-Orange and become customer without going to the branch.

+ Corporate clients can approve bulk foreign currency and salary payments

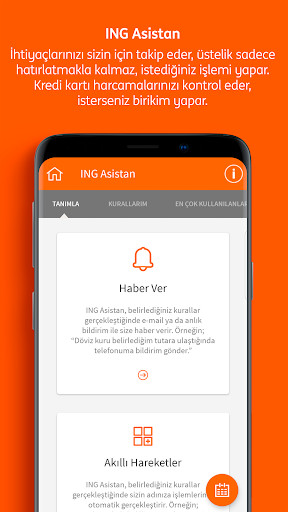

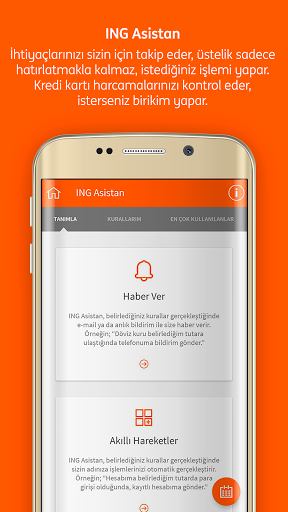

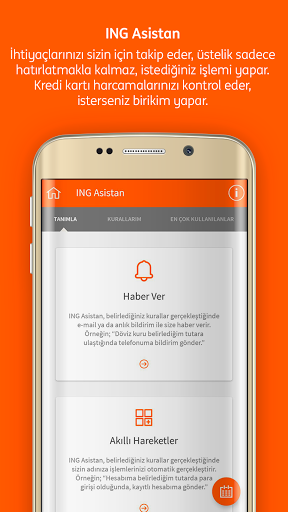

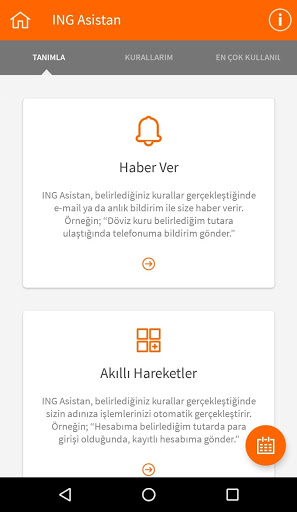

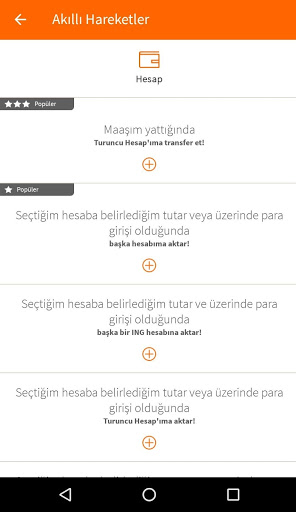

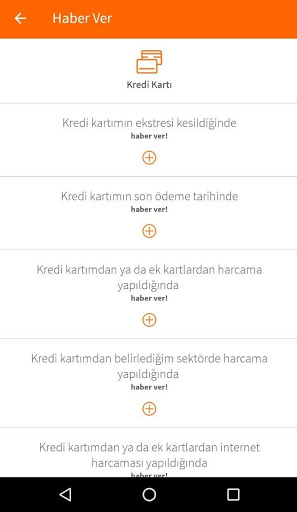

+ You can follow your loan payments with the new rules added to the ING Assistant's Notify feature.

- Notify me when the loan day's payment is approaching

- Notify me when loan is not paid

- Notify me when the loan payment is paid

+ You can save your game of chance payments and make your next payment faster.

+ You can add a new record to My Saved Transactions without making a money transfer.

+ You can apply for housing insurance.

+ Performance enhancements have been carried out.

+Now you can use ING Mobile in English.

+Now you can access your debit cards from my cards menu.

+Private Insurances & Private Pension payments have been added.

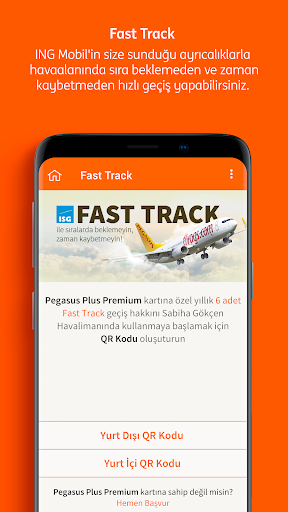

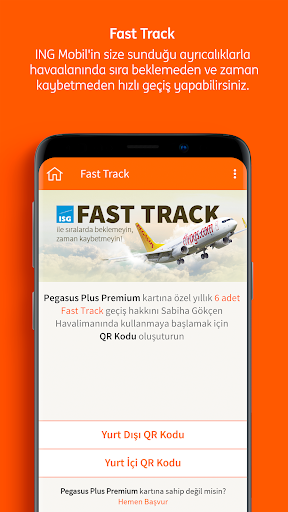

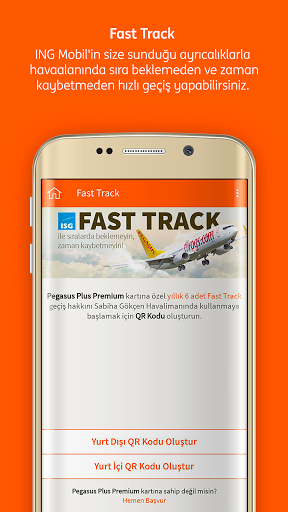

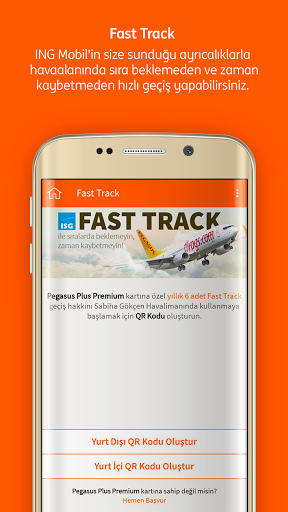

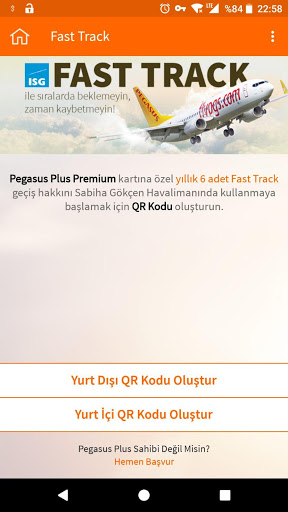

+Private Banking card customers can produce Fast Track QR code which is valid on Sabiha Gökçen airport.

+Corporate users, monthly loan payment feature added.

+Corporate users, login with identity number feature added.

+Corporate users, e-Turuncu account opening feature added.

+Calculation tool added to SME Quick Loan applications.

+ Performance enhancements have been carried out.

Performance enhancements have been carried out.

+ Meet with our AI based banking robot INGo. It is now available on ING Mobile. With INGo you can make a loan application and learn the result quickly. Moreover, you can get detailed information about our other products and other banking related questions.

+ You can observe your Orange Extra card transactions.

+ Credit card statement installment and postponement functions added.

+ ING Private Banking credit card advantages added.

+ Performance enhancements have been carried out.

+ Settings page added to Orange Extra menu.

+ You can now access custom offers more quickly from dashboard.

+ ING SME Quick Loan application feature added for self-employed individuals.

+ Our corporate clients can receive notifications when their corporate credit card statement due date arrived with new ING Assistant rule.

+ Performance enhancements have been carried out.

+ New ING Assistant rule has been added. “Notify me when my credit card limit drops below the pre-set amount”

+ Performance enhancements have been carried out.

+ Spend at least 750 TL per month with your ING Bank Card, pay bill or set up bill payment order, earn 1% additional interest on your e-Orange and Orange TL accounts!

+ Corporate ING mobile users can use loan within their limits without going to branch.

+ Performance enhancements have been carried out.

+ You can log-in the e-Government portal with ING Mobile quickly and easily.

+ You can now contactless payment with NFC supported phones.

+ The institutional payment pages have been renewed and the search feature has been added.

+ ÖSYM payments have been added to institutional payments.

+ Receipt share and display function added.

+ Now you can open a securities account.

+ For our corporate clients, new ING Asistant rules added. They can follow money input / output and the check transactions.

You can apply for Pegasus cards right from application step.Performance enhancements have been carried out.

Performance enhancements have been carried out.

Performance enhancements have been carried out.

Performance enhancements have been carried out.

Your feedbacks are incredibly important for us. We make ING Mobil more talented and user friendly with each new version based on your comments and feedbacks. With new update;+ Now, you can perform Game of Chance payments from Payments > Game of Chance step .+ Performance enhancements have been carried out.

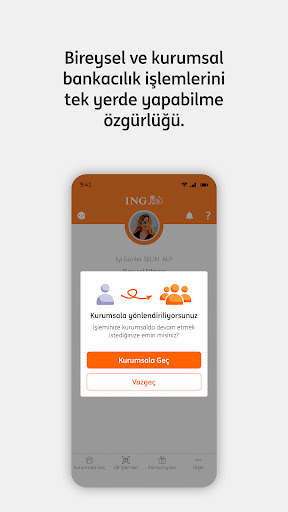

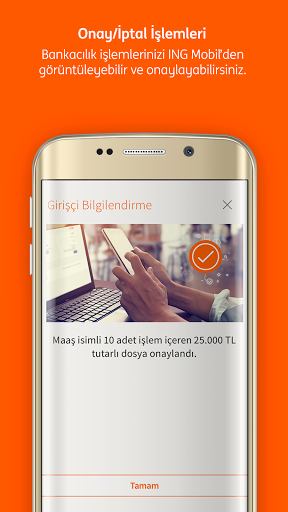

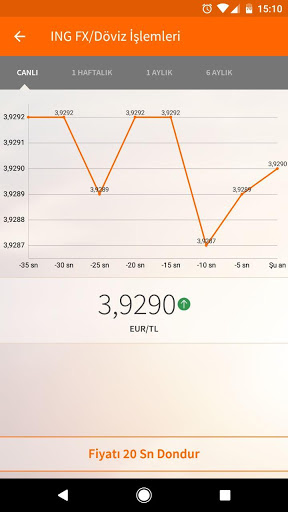

With new update;+ Retail and corporate banking transactions can be done through a single application.+ Retail and corporate banking customers can easily make customs and SGK payments.+ Retail customers will be able to open an e-Orange account in British Sterling.+ Corporate customers will be able to approve their transactions from ING Mobile.+ Corporate customers will be able to buy and sell FX.+ Performance enhancements have been carried out.

Your feedbacks are incredibly important for us. We make ING Mobil more talented and user friendly with each new version based on your comments and feedbacks. With new update;+ With the "Repeat" button where you can access the account movements and account movements detail steps, you can quickly repeat the money transfer transactions you have done before.+ Bonus card application has been added to ING Mobile secure area.+ Performance enhancements have been carried out.

Fixed for better performance.

Your feedbacks are incredibly important for us. We make ING Mobil more talented and user friendly with each new version based on your comments and feedbacks.+ You can perform your arbitrage transactions with ING Mobile.+ You can produce Fast Track QR code which is valid on Istanbul Sabiha Gökçen airport.+ Now, you can apply for our new product Pegasus Premium card from Fast Track menu.+ Now, the nearest branch will be selected on Qmatic.+ Performance enhancements have been carried out.

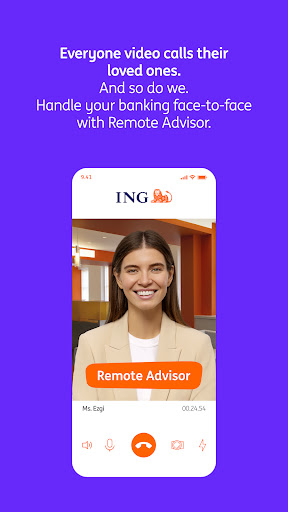

Your feedbacks are incredibly important for us. We make ING Mobil more talented and user friendly with each new version based on your comments and feedbacks.+Live Support Feature has been added.+Performance enhancements have been carried out.

tecno Phantom 6

tecno Phantom 6